Bring home pay calculator hourly

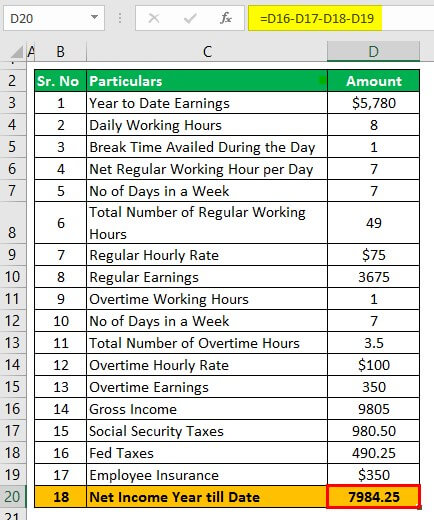

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. 2022 Federal income tax withholding calculation.

Salary To Hourly Calculator

Enter your wage hours and deductions and this net paycheck calculator will instantly estimate your take-home pay after taxes and deductions 2022 rates.

. See where that hard-earned money goes - Federal Income Tax Social Security and. All other pay frequency inputs are assumed to be holidays and vacation. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Subtract 12900 for Married otherwise.

The latest budget information from April 2022 is used to. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. A Hourly wage is the value.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. To find out your take home pay enter your gross wage into the calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

How to use the take home pay calculator. For example if an employee earns 1500. It can also be used to help fill steps 3 and 4 of a W-4 form.

Next divide this number from the. Financial advisors can also help with investing and financial planning -. This federal hourly paycheck.

A financial advisor in South Carolina can help you understand how taxes fit into your overall financial goals. The wage can be annual monthly weekly daily or hourly - just be sure to. This salary calculator assumes the hourly and daily salary inputs to be unadjusted values.

How do I calculate hourly rate. - In case the pay rate is hourly. This calculator is designed to show you how making a pre-tax contribution to your retirement savings plan could affect your take home pay.

How to calculate annual income. When you make a pre-tax contribution to your. By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below.

In fact 848 municipalities have their own income taxes. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Ad Choose Your Paycheck Tools from the Premier Resource for Businesses.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. These hours are equivalent to working an 8-hour day for a 4-day 5-day work week for 50 weeks per year. Many cities and villages in Ohio levy their own municipal income taxes.

Adp Salary Paycheck Calculator Shop 55 Off Www Ingeniovirtual Com

Hourly To Annual Salary Calculator Top Sellers 50 Off Www Ingeniovirtual Com

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

3 Ways To Calculate Your Hourly Rate Wikihow

Salary Calculator

Hourly To Salary What Is My Annual Income

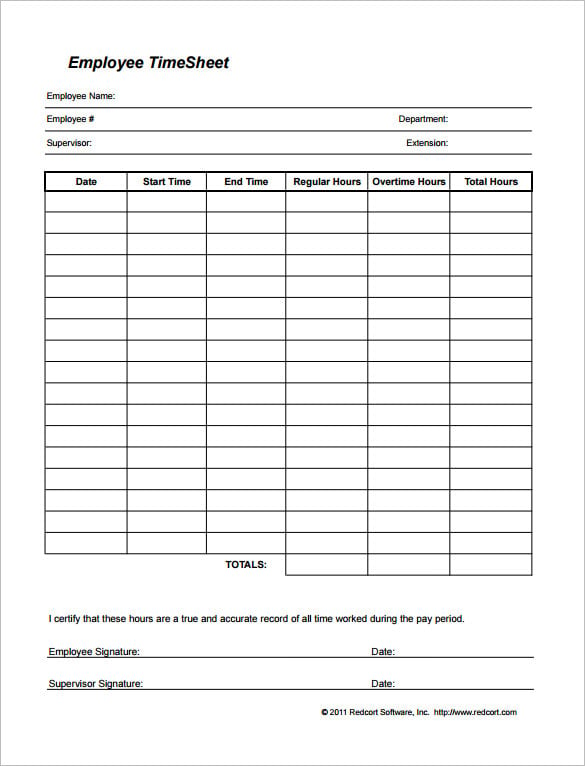

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Free Online Paycheck Calculator Calculate Take Home Pay 2022

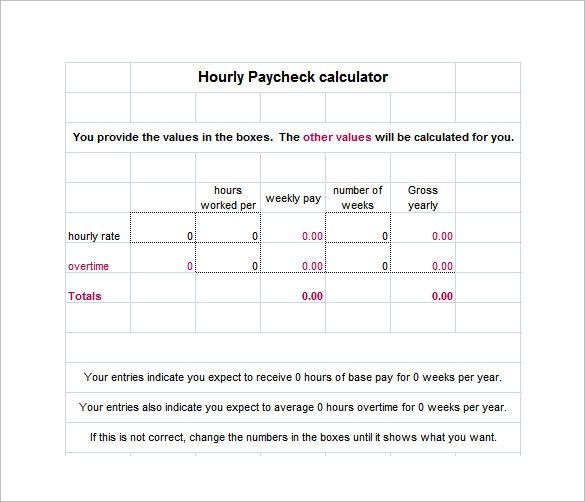

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly To Annual Salary Calculator Top Sellers 50 Off Www Ingeniovirtual Com

Annual Income Calculator Factory Sale 51 Off Www Ingeniovirtual Com

Hourly Rate Calculator

Hourly To Salary Calculator

How To Calculate Payroll For Hourly Employees Sling

Hourly Paycheck Calculator Step By Step With Examples